How much does child care cost?

ReadEach year, Erie County releases average market rates. They are a guideline of the cost of child care from New York State Office of Children and Family Services (OCFS). The market rate is based on the county where the child care is provided, the type of setting, and the age of the child (the younger the child the higher the rate). The following are effective June 1, 2024:

| Day Care Center | $265-$340 |

| School-Age Child Care | $265-$300 |

| Family Day Care & Group Family Day Care Home | $240-$300 |

| Legally Exempt (Group Child Care) | $215-$265 |

| Legally Exempt (In-Home Standard) | $176-$205 |

| Legally Exempt (In-Home Enhanced) | $189-$201 |

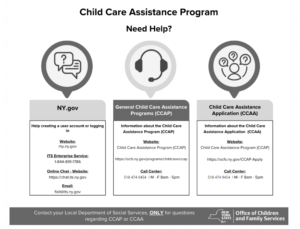

Child Care Assistance Program

ReadWorkforce Development Institute (WDI) Child Care Subsidy Program

ReadThe WDI Child Care Subsidy Program was created through an initiative of organized labor and community partners to help working families offset the high cost of child care.

Click here for WDI Information

Tax credits for families & employers

ReadEmployer support

ReadYour employer may provide discounts or have agreements with programs for reduced rates. Many employers offer Dependent Care Assistance Programs, which will allow you to deduct up to $5,000 a year from your paycheck on a pre-tax basis, for the purpose of paying for child care.

Other Child Care payment help

ReadScholarships: Check with your provider to see if they offer or accept various scholarship funds.

Sliding Scale Fee: The cost of the program is based on income standards of the parent, set by the program.

Multi-Child Discounts: Ask the program if they offer discounts for bringing enrolling more than one child.

Head Start/Early Head Start/Universal Pre-K (UPK): These federally-funded full or part day programs provide free education and other services to help get children ready for school. Eligibility is based on income.

UPK: Contact your local school district for more information.

Local Head Start/Early Head Start programs:

-

- Community Action Organization of Erie County, Inc. (CAO Head Start): 716-533-8975

- Holy Cross Head Start: 716-852-8373

College Students: Some colleges have their own child care center, and may offer a discount to their students. Local college and universities with child care centers in Erie County that offer discounts for their students include Buffalo State College and University at Buffalo.